3QFY2019 Result Update | IT

January 11, 2019

Tata Consultancy Services (TCS)

NEUTRAL

CMP

`1,889

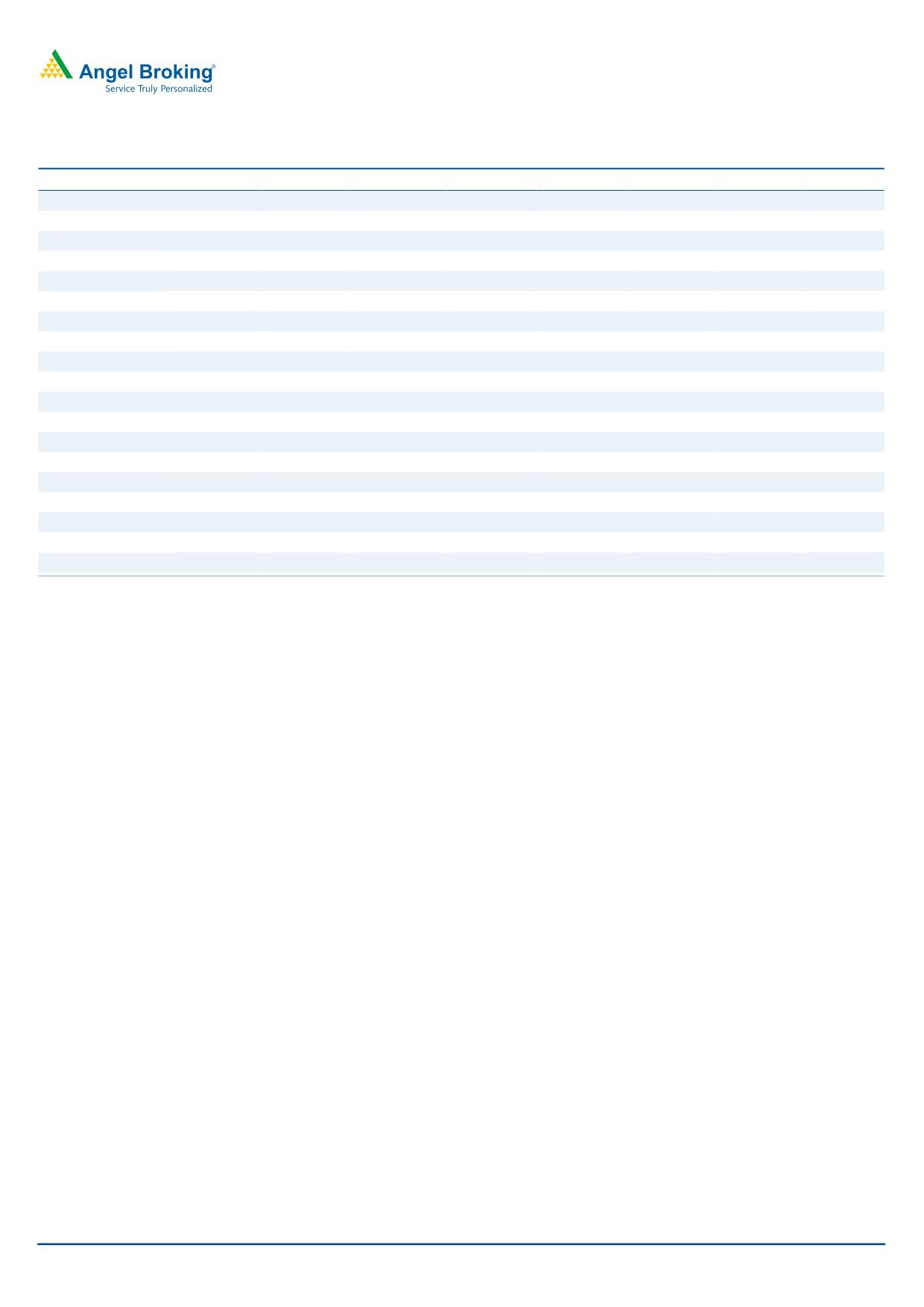

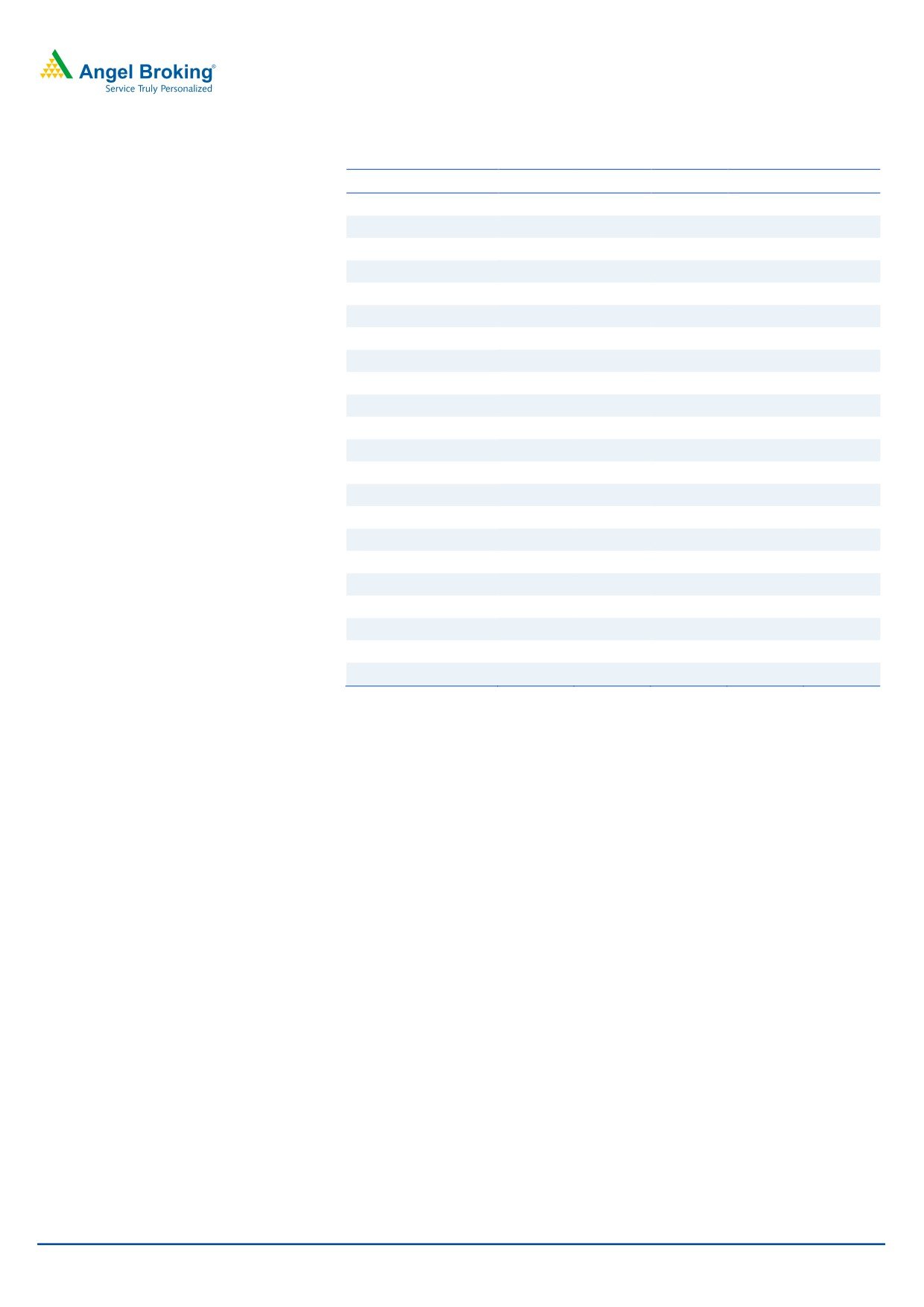

Performance highlights

Target Price

(` cr)

3QFY19

2QFY19 % chg (QoQ) 3QFY18

% chg (yoy)

Investment Period

12 Months

Net revenue

37,338

36,854

1.3

30,904

20.8

Adj. EBITDA

7,065

10,364

(31.8)

8,287

(14.7)

Adj. EBITDA margin (%)

27.2

28.1

(92)bp

26.8

39bp

Adj. PAT

8,105

7,901

2.6

6,531

24.1

Source: Company, Angel Research

Stock Info

Sector

IT

TCS posted a

0.7% sequential growth in USD revenues to US$5,250mn v/s

Market Cap (` cr)

708,507

US$5,215mn in 2QFY2019. In rupee terms, revenues came in at `37,338cr V/s `36,854cr,

Net Debt (` cr)

(45,288)

up 1.3% QoQ. In Constant Currency (CC) terms, the company posted a 1.8% QoQ

Beta

0.3

growth. On profitability front, EBIT margin showed a dip of ~90bps QoQ to 25.6%.

52 Week High / Low

2,273/1,349

Avg. D aily Volum e

192,405

Consequently, PAT came in at 8,105cr v/s `7,901cr in 2QFY2019, up of 2.6% QoQ. We

Face Value (`)

1

recommend a neutral rating on the stock.

BSE Sensex

36,107

Nifty

10,822

Quarterly highlights: TCS posted a 0.7% sequential growth in USD revenues to

Reuters Code

TCS.BO

US$5,250mn v/s US$5,215mn in 2QFY2019. In Constant Currency (CC) terms, the

Bloomberg Code

TCS@IN

company posted a 1.8% QoQ growth. Geography wise, the growth was broadly well

spread. In terms of verticals, key verticals BFSI, Retail & CPG & Communication &

Shareholding Pattern (%)

Prom oters

72.1

Media registered a yoy CC growth of 8.6%, 10.5% and 10.8% respectively. Other

MF / Banks / Indian Fls

7.8

verticals like Manufacturing & Technology Services posted yoy growth of 6.7% and

FII / NRIs / OCBs

16.1

5.8% on CC terms. On profitability front, EBIT margin showed a dip of ~90bps QoQ to

Indian Public / Others

4.1

25.6%. Consequently, PAT came in at 8,105cr V/s `7,901cr in 2QFY2019, up 2.6% QoQ.

Abs .(% )

3m

1 yr

3 yr

Outlook and valuation: Over FY2018-21E, we expect TCS to post revenue CAGR

Sensex

2.7

4.9

45.4

of 9.5% & 13.1% in USD & INR terms respectively. The company highlighted that

TCS

(1.1)

34.5

59.8

it stands comfortable in sustaining the EBIT margin in the range of 26-28%. On

the EBIT and PAT fronts, we expect the company to post 13.4% and 11.7% CAGR

over FY2018-21E respectively. The stock is trading at 21.3x FY2020E EPS of

`88.7.Valuations already discount a robust medium growth & favorable

3-Year Daily Price Chart

operating environment and valuations are higher than its P/E averages.

2,500

However, given the good cash yield we recommend a Neutral.

2,000

Key financials (Consolidated, IFRS)

1,500

Y/E March (` cr)

FY2018

FY2019

FY2020E

FY2021E

1,000

Net sales

123,104

149,085

163,248

177,941

% chg

4.4

21.1

9.5

9.0

500

Net profit

25,826

31,194

33,284

36,030

0

% chg

(1.8)

20.8

6.7

8.3

EBITDA margin (%)

26.6

27.2

26.7

26.7

EPS (`)

67.5

83.1

88.7

96.0

Source: Company, Angel Research

P/E (x)

28.0

22.7

21.3

19.7

P/BV (x)

8.2

8.4

7.5

6.7

RoE (%)

29.5

36.9

35.2

34.2

Sarabjit kour Nangra

RoCE (%)

28.0

35.1

33.8

33.1

+91 22 3935 7800 Ext: 6806

EV/Sales (x)

5.3

4.4

3.9

3.6

sarabjit @angelbroking.com

EV/EBITDA (x)

19.8

16.1

14.7

13.3

Source: Company, Angel Research; Note: CMP as of January 10, 2018

Please refer to important disclosures at the end of this report

1

TCS | 3QFY2019 Result Update

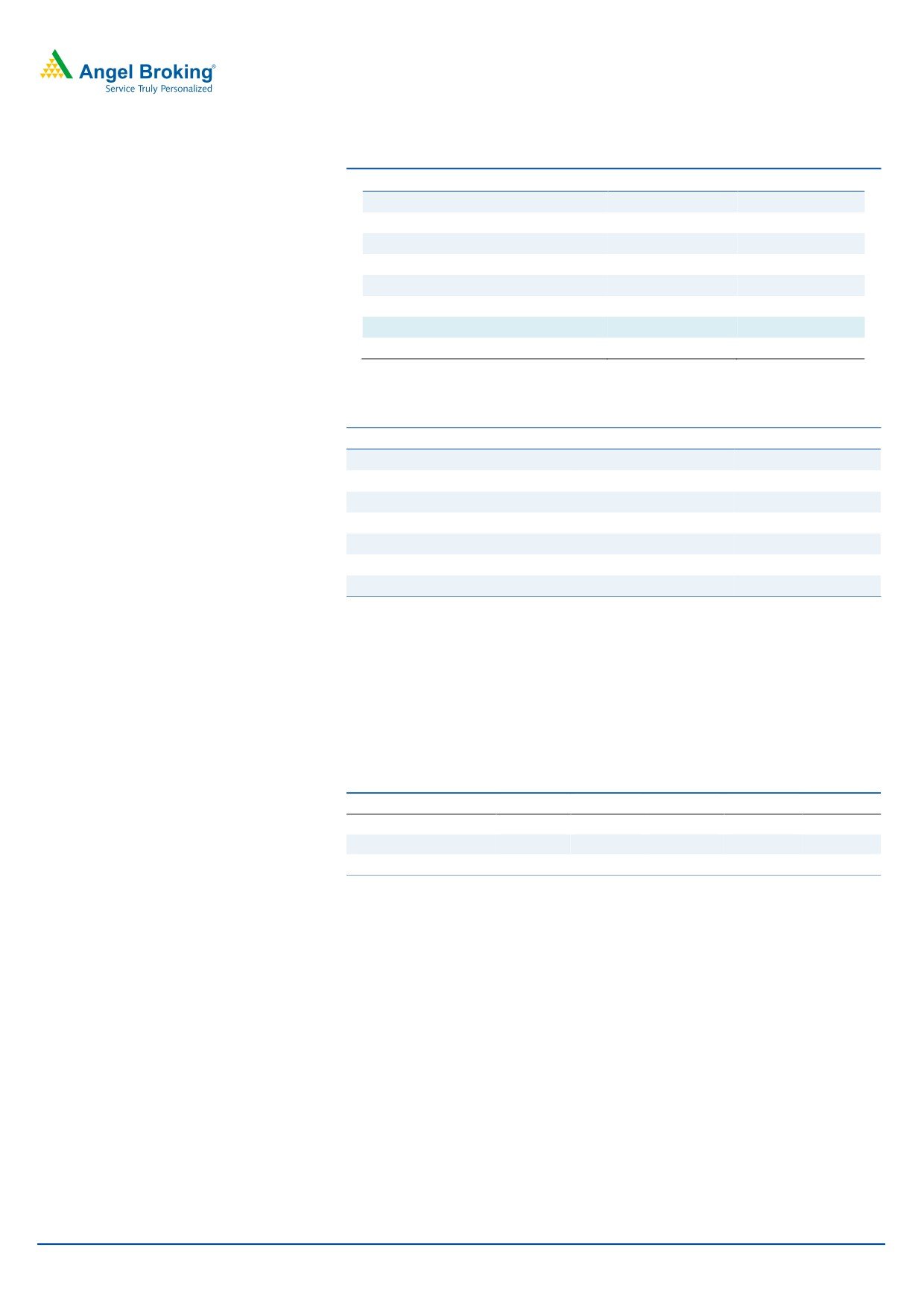

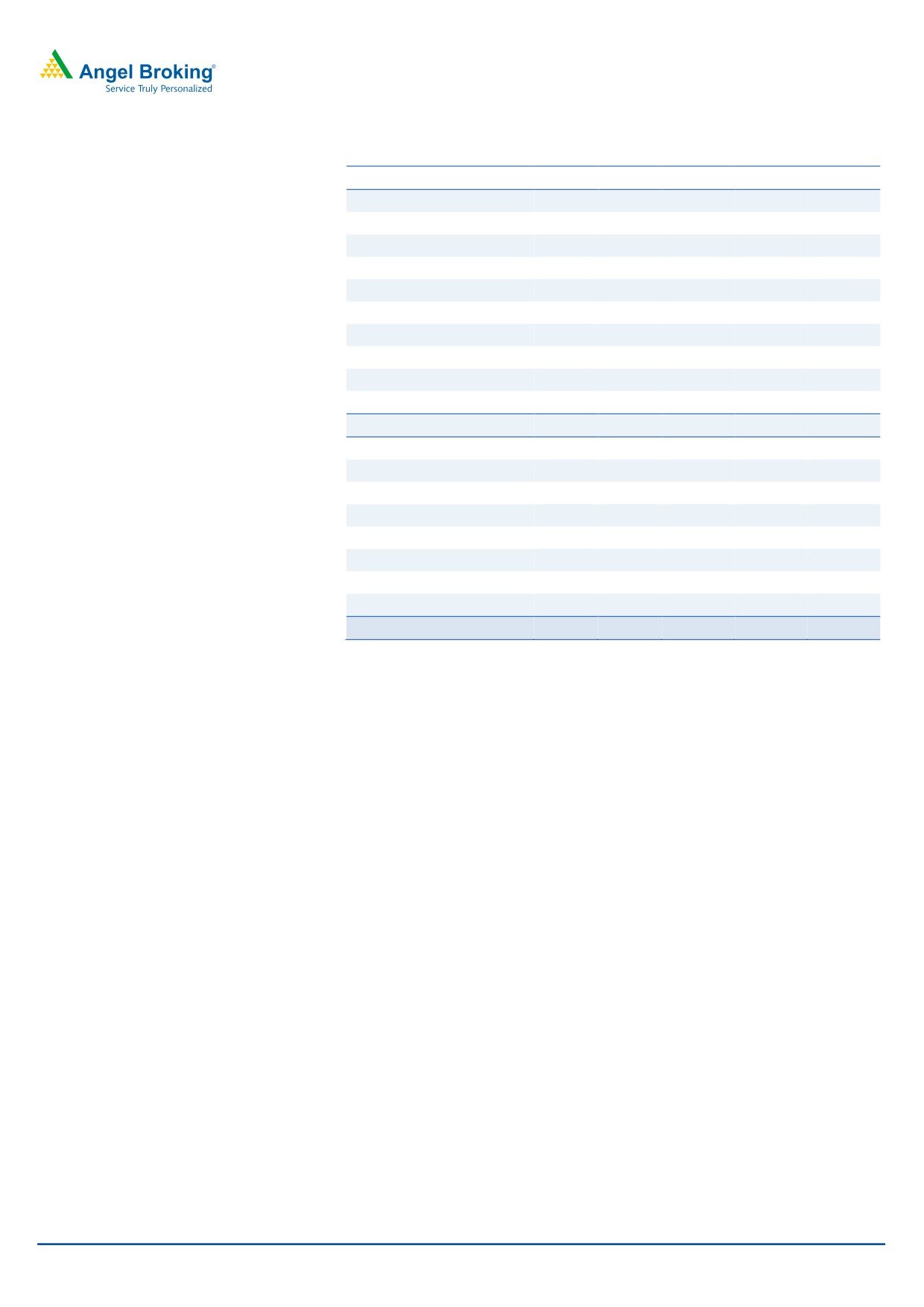

Exhibit 1: 3QFY2019 performance (Consolidated, IFRS)

(` cr)

3QFY2019

2QFY2019

% chg (QoQ) 3QFY2018

% chg (yoy) 9MFY2019 9MFY2018

% chg(yoy)

Net revenue

37,338

36,854

1.3

30,904

20.8

1,08,453

91,029

19.1

Cost of revenue

21,142

20,607

2.6

17,356

21.8

61,434

51,255

19.9

Gross profit

16,196

16,247

(0.3)

13,548

19.5

47,019

39,774

18.2

SG&A expense

6,039

5,883

2.7

5,261

14.8

17,522

15,910

10.1

EBITDA

10,157

10,364

(2.0)

8,287

22.6

29,497

23,864

23.6

Dep. and Amortization

593

593

-

506

17.2

1,584

1,509

5.0

EBIT

9,564

9,771

(2.1)

7,781

22.9

27,913

22,355

24.9

Other income

1,147

593

93.4

864

32.8

2,948

2,608

13.0

PBT

10,711

10,364

3.3

8,645

23.9

30,861

24,963

23.6

Income tax

2,590

2,437

6.3

2,100

23.3

7,451

6,008

24.0

PAT

8,121

7,927

2.4

6,545

24.1

23,410

18,955

23.5

Earnings in affiliates

-

-

-

-

-

-

-

Minority interest

16

26

14

-

-

33

Reported PAT

8,105

7,901

2.6

6,531

24.1

23,410

18,922

23.7

Adj. PAT

8,105

7,901

2.6

6,531

24.1

23,410

18,922

23.7

EPS

21.6

20.7

4.5

16.8

28.3

62.4

49.5

26.1

Gross margin (%)

43.4

44.1

(71)bps

43.8

(46)bps

43.4

43.7

(34)bps

EBITDA margin (%)

27.2

28.1

(92)bps

26.8

39bps

27.2

26.2

98bps

EBIT margin (%)

25.6

26.5

(90)bps

25.2

44bps

25.7

24.6

118bps

Source: Company, Angel Research

Key geographies & verticals doing well

TCS posted a 3.2% sequential growth in USD revenues to US$5,250mn v/s US$5,215mn

in 2QFY2019. In Constant Currency (CC) terms, the company posted a 1.8% QoQ growth.

Geography wise, the growth was broadly well spread. USA - North America & Latin

America registered a yoy CC growth of 8.2% and 7.6% respectively. In Europe- UK &

Continental Europe registered a yoy CC growth of 25.1% and 17.6% respectively. India

& Asia Pacific registered a yoy CC growth of 9.7% and 12.6% respectively.

In terms of verticals, BFSI, Retail & CPG & Communication & Media registered a yoy CC

growth of 8.6%, 10.5% and 10.8% respectively. Other verticals like Manufacturing &

Technology Services posted yoy growth of 6.7% and 5.8% on CC terms. Growth in Digital

was 52.7% yoy in CC terms and it now constitutes to 30.1% of total revenue. Digital was

around 22.1% of sales in 3QFY2018. TCS pipeline expanded across segments and

geographies. Total TCV of deals in 3QFY2019 amounted to US$ 5.9bn.

January 11, 2019

2

TCS | 3QFY2019 Result Update

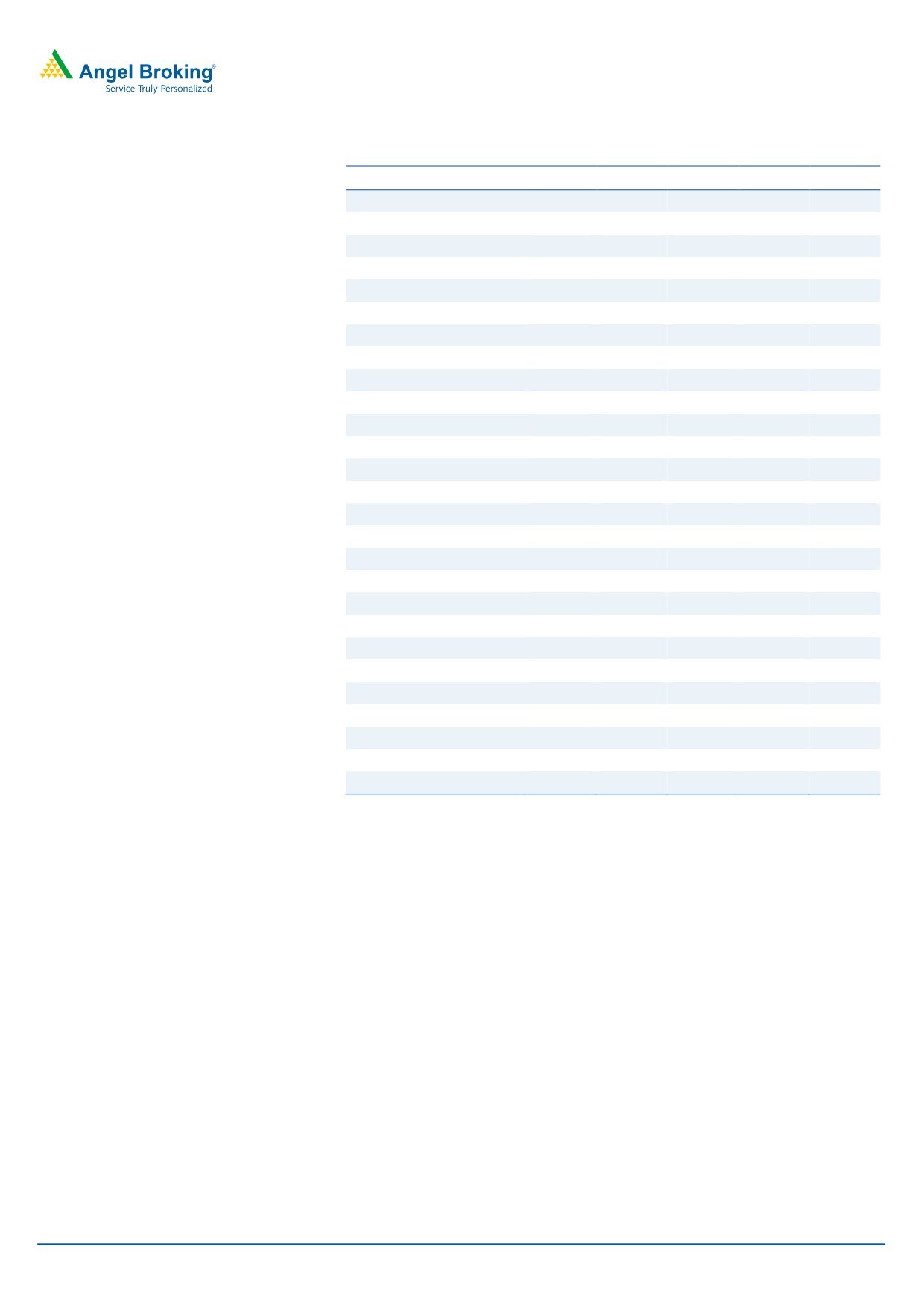

Exhibit 2: Revenue growth (Industry wise on CC basis)

% to revenue

% chg (yoy)

BFSI

30.8

8.6

Manufacturing

7.2

6.7

Communication & Media

6.9

10.8

Life sciences and healthcare

7.6

15.7

Retail and CPG

16.5

10.5

Energy and utilities

4.7

18.1

Technology & Services

7.6

5.8

Regional Markets & Others

18.7

22.6

Source: Company, Angel Research

Exhibit 3: Revenue growth (Geography wise in INR terms)

% of revenue

% chg (yoy)

U.S.

51.2

8.2

Latin America

2.0

7.6

U.K.

15.5

25.1

Continental Europe

14.1

17.6

India

5.7

9.7

Asia Pacific

9.4

12.6

MEA

2.1

(3.3)

Source: Company, Angel Research

Attrition rate inches up

In 3QFY2019, TCS witnessed a gross addition of 12,534 employees and net addition of

6,827 employees, taking its total employee base to 4,17,929. During the quarter, the

attrition rate (last twelve-month [LTM] basis) for the company increased to 11.2% from

10.9% in 2QFY2019.

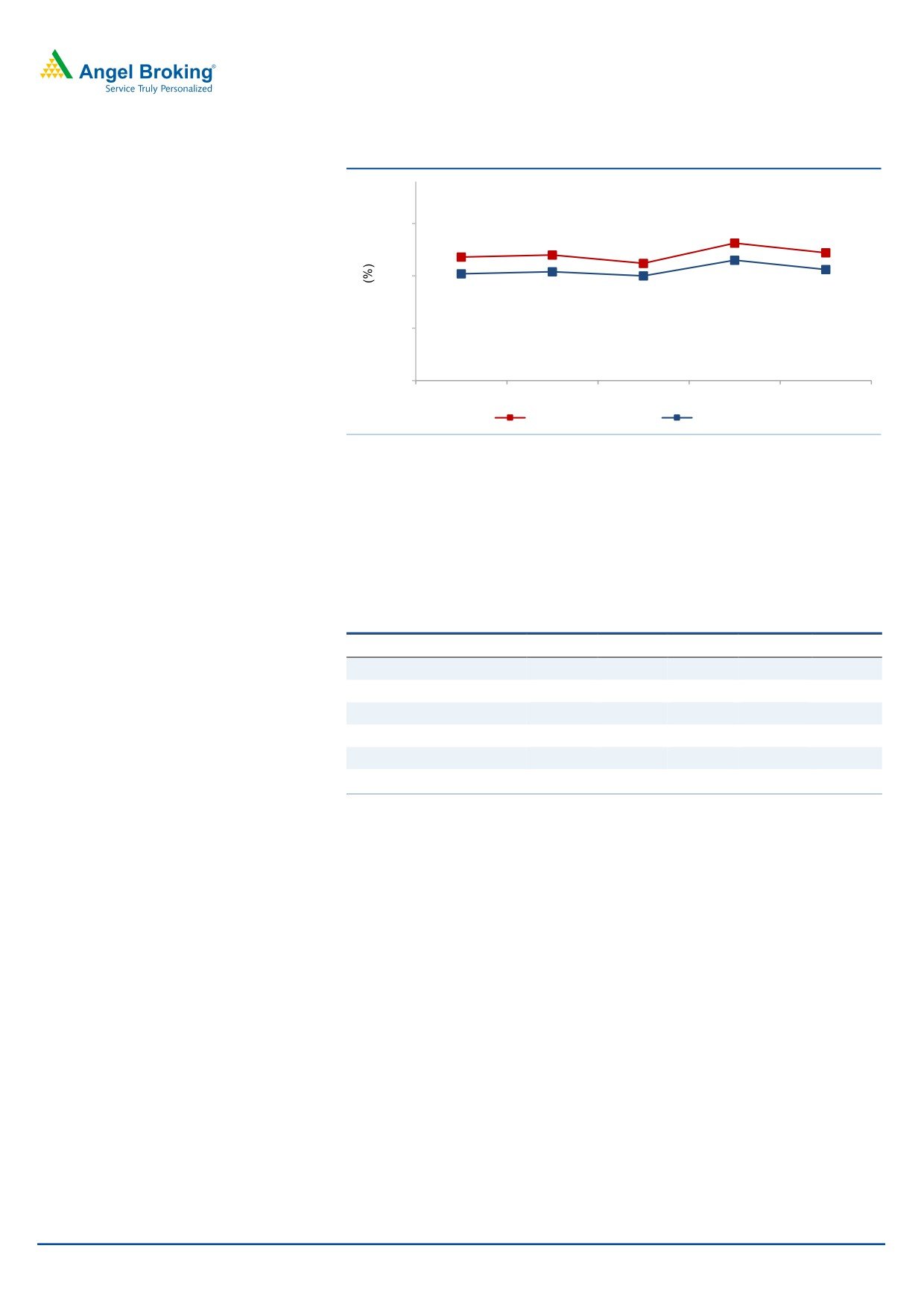

Exhibit 4: Hiring & attrition trend

Particulars

3QFY18 4QFY18

1QFY19

2QFY19

3QFY19

Net addition

3,404

1,667

4,118

5,877

6,827

Total employee base

3,90,880

3,94,998

4,00,875

4,11,102

4,17,929

Attrition (%) - LTM basis

11.9

11.8

11.7

10.9

11.2

Source: Company, Angel Research

Margin dips; mainly driven by subcontracting costs

On the operating front, the company reported EBITDA and EBIT margins at 27.2%

and 25.6%, i.e. a dip of 92ps and 90bps QoQ respectively. A major part of the dip

was on back of subcontracting costs. Sub-con costs were 7.9% of revenues (the

highest in recent history) compared to 7.2% in 2QFY2019. The company has

maintained an EBIT margin target of 26-28%.

January 11, 2019

3

TCS | 3QFY2019 Result Update

Exhibit 5: Adj. Margin profile (%)

30

28.1

26.8

27.0

27.2

26.2

25

26.5

25.2

25.4

25.6

25.0

20

15

3QFY18

4QFY18

1QFY19

2QFY19

3QFY19

EBITDA margin

EBIT margin

Source: Company, Angel Research

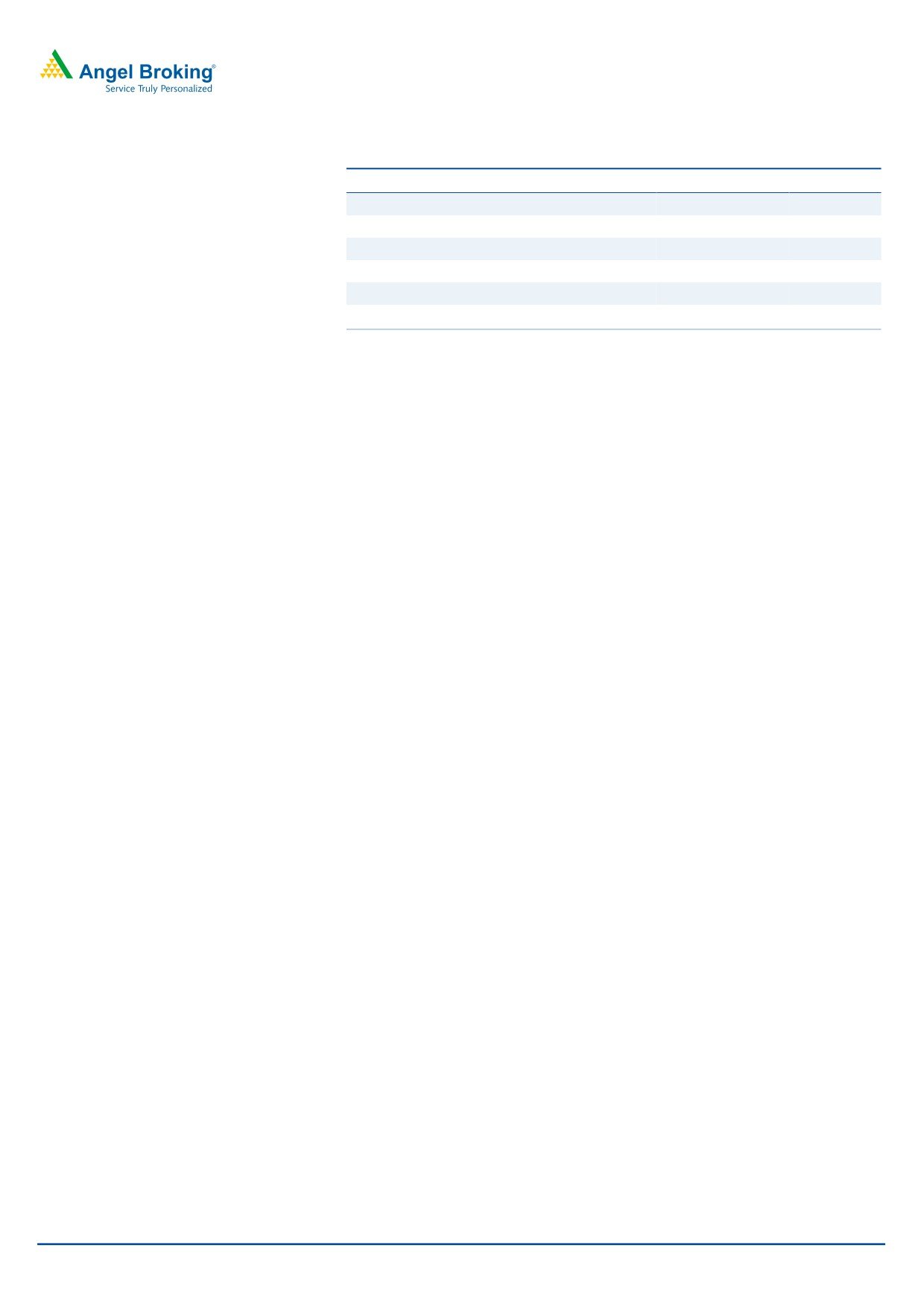

Client metrics

The client pyramid during the quarter witnessed a qualitative improvement with

client additions seen in the higher revenue brackets. The clients in US$10mn+

revenue band increased by 7 and in US$100mn+ revenue band increased by 1.

Exhibit 6: Client pyramid

3QFY18 4QFY18 1QFY19 2QFY19 3QFY19

US$1mn-5mn

456

468

470

476

477

US$5mn-10mn

148

145

153

148

149

US$10mn-20mn

134

143

149

152

159

US$20mn-50mn

109

110

109

115

112

US$50mn-100mn

57

59

57

54

54

US$100mn plus

37

38

40

44

45

Source: Company, Angel Research

Outlook & Valuations

Over FY2018-21E, we expect TCS to post revenue CAGR of 9.5% & 13.1% in USD &

INR terms respectively. The company highlighted that it stands comfortable in

sustaining the EBIT margin in the range of 26-28%. On the EBIT and PAT fronts, we

expect the company to post 13.4% and 11.7% CAGR over FY2018-21E respectively.

The stock is trading at 21.3x FY2020E EPS of `88.7. Valuations already discount a

robust medium growth and favorable operating environment and is at slight

premium to its long-term P/E averages. However, given the cash yield we

recommend a Neutral.

January 11, 2019

4

TCS | 3QFY2019 Result Update

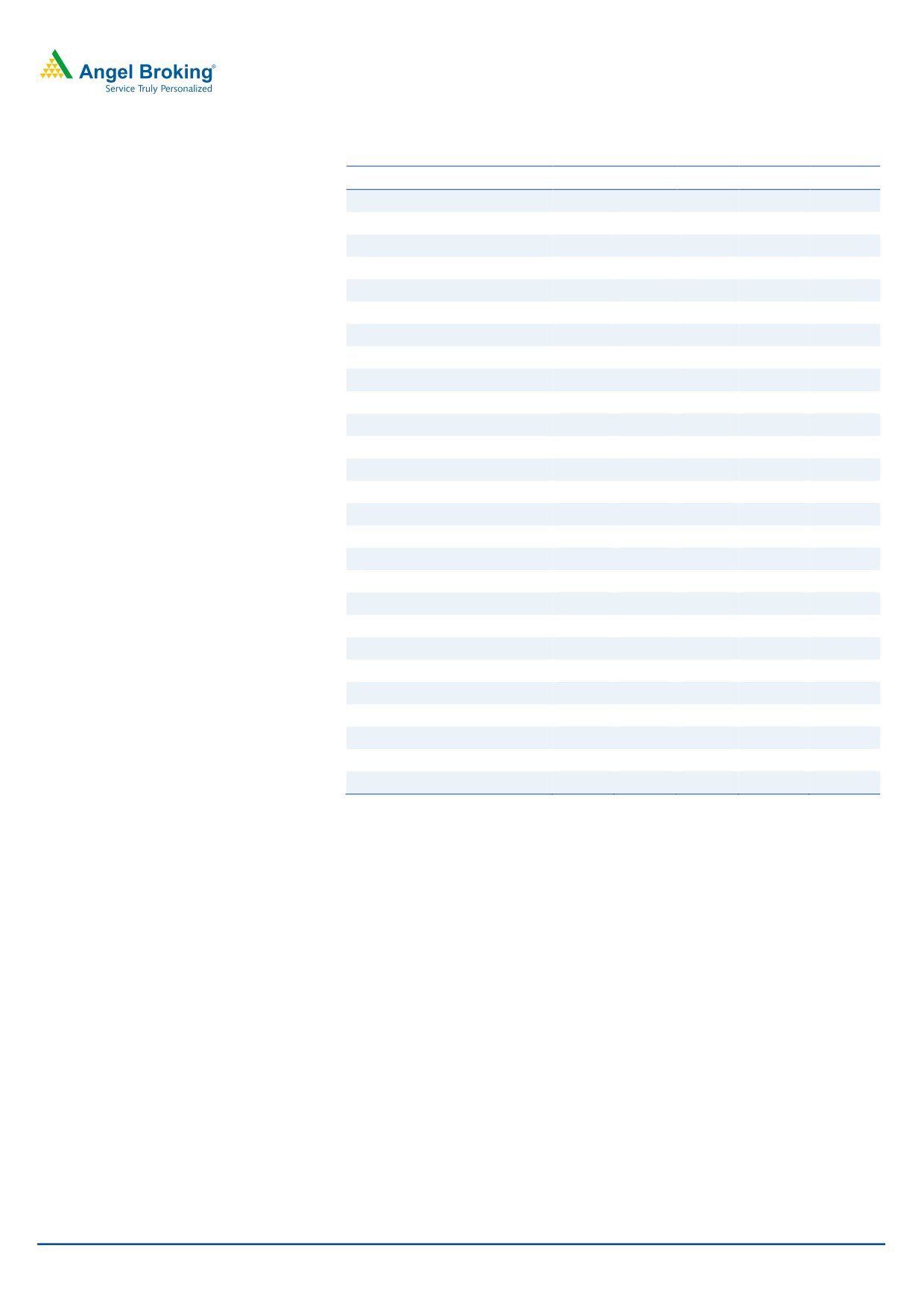

Exhibit 7: Key assumptions

FY2020E

FY2021E

Revenue growth (USD)

9.5

9.0

USD-INR rate (realized)

71.0

71.0

Revenue growth (%)

9.5

9.0

EBITDA margin (%)

26.7

26.7

Tax rate (%)

25.0

25.0

EPS growth (%)

6.7

8.3

Source: Company, Angel Research

Company background

TCS is Asia's largest IT services provider and is amongst the top 10 technology firms

in the world. The company has a global footprint with an employee base of over

4lakh professionals, offering services to more than 1,000 clients across various

industry segments. The company has one of the widest portfolios of service

offerings, spanning across the entire IT service value chain - from traditional

application development and maintenance to consulting and package

implementation to products and platforms.

January 11, 2019

5

TCS | 3QFY2019 Result Update

Profit & Loss statement (Consolidated, IFRS)

Y/E March (` cr)

FY2017

FY2018

FY2019

FY2020E FY2021E

Net sales

117,966

123,104

149,085

163,248

177,941

Cost of revenue

64,764

69,072

82,444

90,276

98,401

Gross profit

53,202

54,032

66,641

72,972

79,539

% of net sales

45.1

43.9

44.7

44.7

44.7

SGA expenses

20,755

21,314

26,090

29,385

32,029

% of net sales

17.6

17.3

17.5

18.0

18.0

EBITDA

32,447

32,718

40,551

43,587

47,510

% of net sales

27.5

26.6

27.2

26.7

26.7

Dep. and amortization

2123

2216

2534

2775

3025

% of net sales

1.8

1.8

1.7

1.7

1.7

EBIT

30,324

30,502

38,017

40,812

44,485

% of net sales

25.7

24.8

25.5

25.0

25.0

Other income, net

4189

3590

3700

3700

3700

Profit before tax

34,513

34,092

41,717

44,512

48,185

Provision for tax

8,156

8,212

10,429

11,128

12,046

% of PBT

23.6

24.1

25.0

25.0

25.0

PAT

26,357

25,880

31,288

33,384

36,139

Minority interest

68

54

94

100

108

Extra-ordinary (Exp.)/ Inc.

Reported PAT

26,289

25,826

31,194

33,284

36,030

Adj. PAT

26,289

25,826

31,194

33,284

36,030

Diluted EPS (`)

68.7

67.5

83.1

88.7

96.0

January 11, 2019

6

TCS | 3QFY2019 Result Update

Balance sheet (Consolidated, IFRS)

Y/E March (` cr)

FY2017 FY2018

FY2019 FY2020E FY2021E

Assets

Cash and cash equivalents

3,597.0

4,883.0

5,240.4

5,326.2

4,782.0

Other current financial assets

-

6,395

6,395

6,395

6,395

Accounts receivable

22,684

24,943

27,437

30,181

33,199

Unbilled revenues

5,351

6,686

8,097

8,866

9,664

Other current assets

7,258

2,610

2,610

2,610

2,611

Property and equipment

11,741

11,600

11,700

11,800

11,900

Intangible assets and goodwill

3,768

3,896

3,896

3,896

3,896

Investments

41,980

36,008

30,908

39,747

50,074

Other non-current assets

8,974

12,034

12,034

12,034

12,034

Total assets

105,353

109,055

108,318

120,856

134,555

Liabilities

Current liabilities

14,294

17,828

20,146

22,765

25,724

Short term borrowings

218

193

193

193

194

Redeemable preference shares

-

-

-

-

-

Long term debt

71

54

54

54

55

Other non-current liabilities

2,089

2,935

2,935

2,935

2,935

Minority interest

366

402

402

402

403

Shareholders’ funds

88,315

87,643

84,588

94,507

105,244

Total liabilities

105,353

109,055

108,318

120,856

134,555

January 11, 2019

7

TCS | 3QFY2019 Result Update

Cash flow statement (Consolidated, IFRS)

Y/E March (` cr)

FY2017 FY2018 FY2019 FY2020E FY2021E

Pre-tax profit from oper.

26,357

25,880

31,288

33,384

36,139

Depreciation

2,123

2,216

2,534

2,775

3,025

Exp. (deferred)/written off

-

-

-

-

-

Pretax cash from oper

28,480

28,096

33,822

36,159

39,164

Other inc./prior period ad

2,123

2,216

2,534

2,775

3,025

Net cash from operations

30,604

30,312

36,356

38,934

42,189

Tax

8,156

8,212

10,429

11,128

12,046

Cash profits

22,448

22,100

25,927

27,806

30,143

(Inc)/dec in acc. recv.

1,389

(2,259)

(2,494)

(2,744)

(3,018)

(Inc)/dec in unbilled rev.

(1,359)

(1,335)

(1,411)

(769)

(798)

(Inc)/dec in oth. current asst.

(1,283)

4,648

-

-

(1)

Inc/(dec) in current liab.

49

141

(100)

(100)

(100)

Net trade working capital

(1,204)

1,195

(4,005)

(3,613)

(3,917)

Cash flow from opert. actv.

21,243

23,295

21,922

24,194

26,225

(Inc)/dec in fixed assets

49

141

(100)

(100)

(100)

(Inc)/dec in investments

(14,325)

(423)

5,100

(8,839)

(10,327)

(Inc)/dec in intangible asst.

(178)

128

-

-

-

(Inc)/dec in non-cur.asst.

2,945

(3,060)

-

-

-

Cash flow from invt. actv.

(11,509)

(3,214)

5,000

(8,939)

(10,427)

Inc/(dec) in debt

44

(42)

-

-

-

Inc/(dec) in minority int.

12

36

-

-

-

Dividends

(19,993)

(11,258)

(18,248)

(23,365)

(25,293)

Others

10,202

(8,816)

(8,673)

8,111

9,494

Cash flow from finan. actv.

(9,735)

(20,080)

(26,921)

(15,254)

(15,799)

Cash generated/(utilized)

1,735

1,286

357

86

(544)

Cash at start of the year

1,862

3,597

4,883

5,240

5,326

Cash at end of the year

3,597

4,883

5,240

5,326

4,782

January 11, 2019

8

TCS | 3QFY2019 Result Update

Key ratios

Y/E March

FY2017 FY2018 FY2019 FY2020E FY2021E

Valuation ratio(x)

P/E (on FDEPS)

27.5

28.0

22.7

21.3

19.7

P/CEPS

25.4

25.8

21.0

19.7

18.1

P/BVPS

8.2

8.2

8.4

7.5

6.7

Dividend yield (%)

1.2

1.3

2.2

2.8

3.1

EV/Sales

5.5

5.3

4.4

3.9

3.6

EV/EBITDA

20.0

19.8

16.1

14.7

13.3

EV/Total assets

6.2

5.9

6.0

5.3

4.7

Per share data (`)

EPS

68.7

67.5

83.1

88.7

96.0

Cash EPS

74.3

73.3

89.9

96.1

104.1

Dividend

23.5

25.0

41.6

53.2

57.6

Book value

231

229

225

252

280

DuPont analysis

Tax retention ratio (PAT/PBT)

0.8

0.8

0.8

0.8

0.8

Cost of debt (PBT/EBIT)

1.1

1.1

1.1

1.1

1.1

EBIT margin (EBIT/Sales)

0.3

0.2

0.3

0.3

0.3

Asset turnover ratio (Sales/Assets)

1.1

1.1

1.4

1.4

1.3

Leverage ratio (Assets/Equity)

1.2

1.2

1.3

1.3

1.3

Operating ROE

29.8

29.5

37.0

35.3

34.3

Return ratios (%)

RoCE (pre-tax)

28.8

28.0

35.1

33.8

33.1

Angel RoIC

50.7

49.4

57.8

58.8

60.7

RoE

29.8

29.5

36.9

35.2

34.2

Turnover ratios(x)

Asset turnover (fixed assets)

10.0

10.6

12.7

13.8

15.0

Receivables days

70

74

67

67

68

January 11, 2019

9

TCS | 3QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

TCS

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 11, 2019

10